Markets Moved by Tsunami and Saudi Arabia

| Last Week in Review: Our hearts and minds – as well as the markets – were moved by the tsunami in Japan and unrest in Saudi Arabia. Read how both impacted Bonds and home loan rates!

Forecast for the Week: Double dose after double dose hits the news wires this week. Find out what to watch and why! View: Discover the pros, cons, and interesting tidbits about Daylight Saving Time, which begins this week. |

||

| Last Week in Review |

| “And now… the rest of the story” – Paul Harvey. With his famous line, Paul Harvey pointed out for years that there’s more to every story – and often those hidden details influence what happened. With that in mind, let’s look at the “rest of the story” behind last week’s news items, which had alternating impacts on Bond prices and home loan rates.

One would think that US Treasuries and Mortgage Bonds would have traded much higher, as often is the case with devastating natural events that drive money into “safe haven” trades. But that wasn’t the case. Why? The answer is that buying of Treasuries and Mortgage Bonds as a safe haven trade was offset by the Japanese selling some of their own massive holdings of Treasuries and Mortgage Bonds, in order to repatriate money back to their country during the time of emergency. Considering that Japan is the second largest holder of U.S. debt at $877 Billion, selling just a tiny position of their holdings has an impact on Bond prices. In addition, Bond prices traded in very volatile fashion last week after getting jockeyed around on news out of Saudi Arabia that police had opened fire on protesters with rubber bullets. Let’s look at how this influenced the markets in a different way than one might at first imagine. Like other recent uprisings in the Middle East, Saudi protesters are looking for more democracy, the right to elect public officials, greater civil rights, freedom of expression, more women’s rights and a higher minimum wage. Interestingly, however, oil fell last week, despite the news. Why? Shouldn’t unrest in Saudi Arabia – the world’s largest oil producer, push prices higher? Yes, but that news was offset by the earthquake in Japan. That’s because Japan is a huge importer of oil… and the market senses that the earthquake and subsequent tsunami may create an economic slowdown and diminish the demand for oil. Seeing that Mortgage Bonds are lower – even in the face of weak Stocks and enormous uncertain global news – tells us that the gains in Bonds are not coming with a lot of conviction and Traders are selling into this strength. This is because a lot of headwinds remain for Bonds – like inflation abroad, rising government debt and continued QE2 purchases. This is a good example of why it is important to work with a mortgage professional that understands not only what was reported in the news, but also how the many cross currents may have alternating effects on everything from Bonds, Stocks, Oil to the US Dollar. |

||

| Forecast for the Week |

“Double dose!” is the phrase of the week, as we’ll see multiple reports this week focusing on the same segments of the economy:

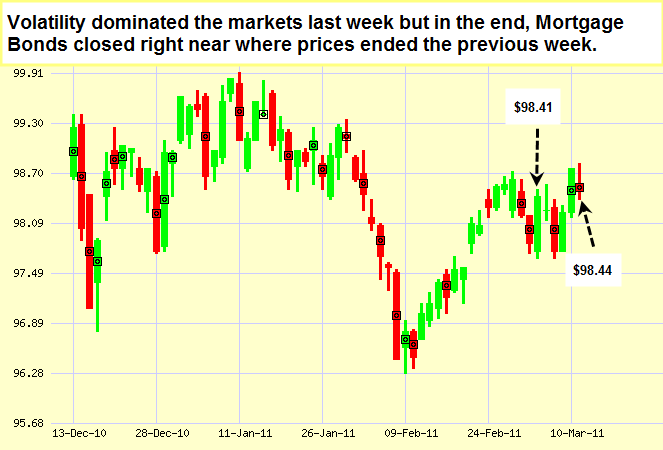

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see by the arrows in the chart below, Bond prices experienced some up-and-down volatility last week, but ended the week near where they began – meaning home loan rates are still near historic lows. So what should you do if you or someone you know is in the market for a new home? The bottom line is that even if housing were to drop a little further in some areas, the affordability coming from today’s rates serves as a backstop against any moderate price reduction. Remember, housing will likely be in a much better position in the second half of the year and at that time rates could be a bit higher. Now’s the time to take advantage of the combination of low rates and affordable housing. Call or email today to get started. Chart: Fannie Mae 4.0% Mortgage Bond (Friday Mar 11, 2011)

|

||

| Sping Forward Beginning March 13 |

First, let us start by sending our thoughts and prayers to the families affected by last week’s earthquake and tsunami in Japan. The earthquake was a magnitude of 8.9 – the strongest in 140 years. The earthquake in Japan and its damage created some counterintuitive market reactions.

First, let us start by sending our thoughts and prayers to the families affected by last week’s earthquake and tsunami in Japan. The earthquake was a magnitude of 8.9 – the strongest in 140 years. The earthquake in Japan and its damage created some counterintuitive market reactions.