How much less home will I be able to buy if I purchase a new car?

The true cost of that new car on your house budget

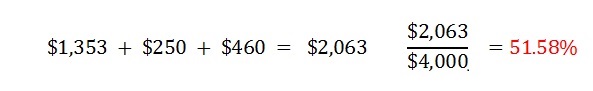

With a proposed payment to income ratio of 33% we can see that she should be able to afford her dream home. When we add to that proposed mortgage payment of $1,353 the student loan debt that she will soon be obligated to repay at $250 per month = $1,603 we can see that she is comfortably within the limits.

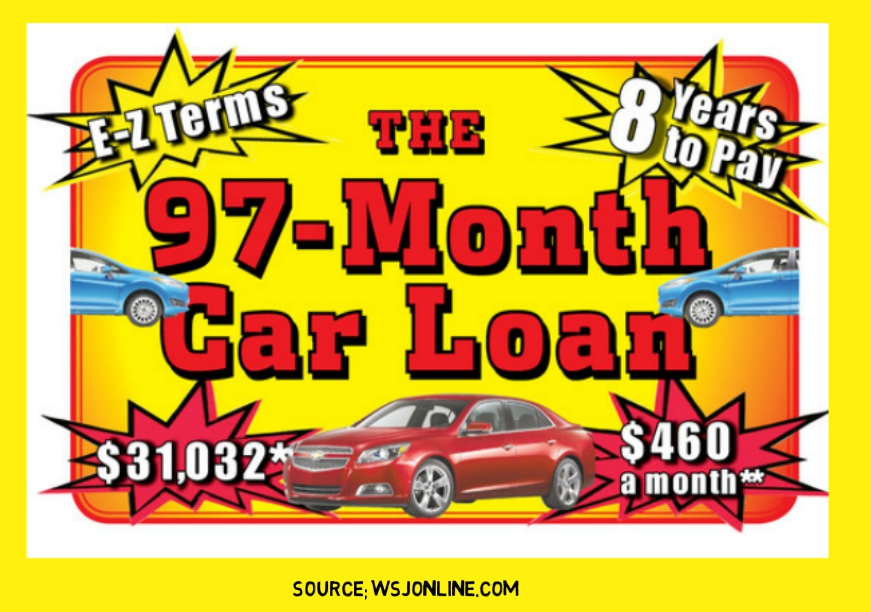

With Jane’s good credit and down payment it looks like Jane can qualify for her dream home. But …what if she decides to buy that new car she’s had her eye on?

With a proposed total Debt to Income in excess of 51% it is unlikely that she will be able to buy her dream home. Jane will either have to make a significantly larger down payment or settle for significantly less home…about $168,993.

Let’s recap –