How much less home will I be able to buy if I purchase a new car?

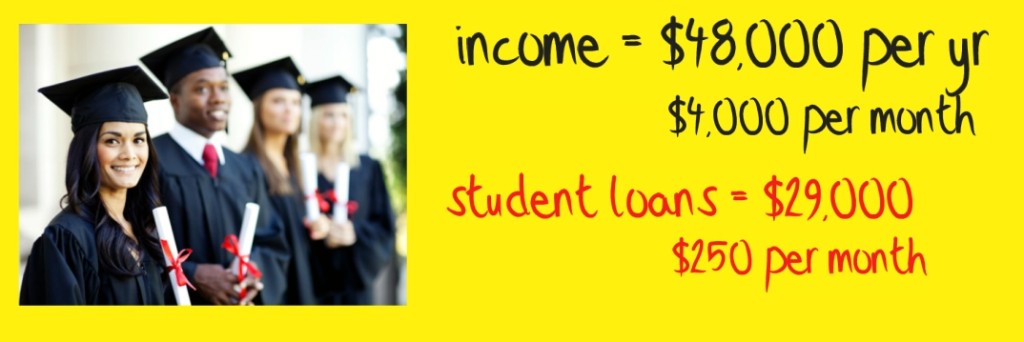

Meet Jane: She’s a recent college grad who is excited to be working in her field of study and is earning $48,000 per year.

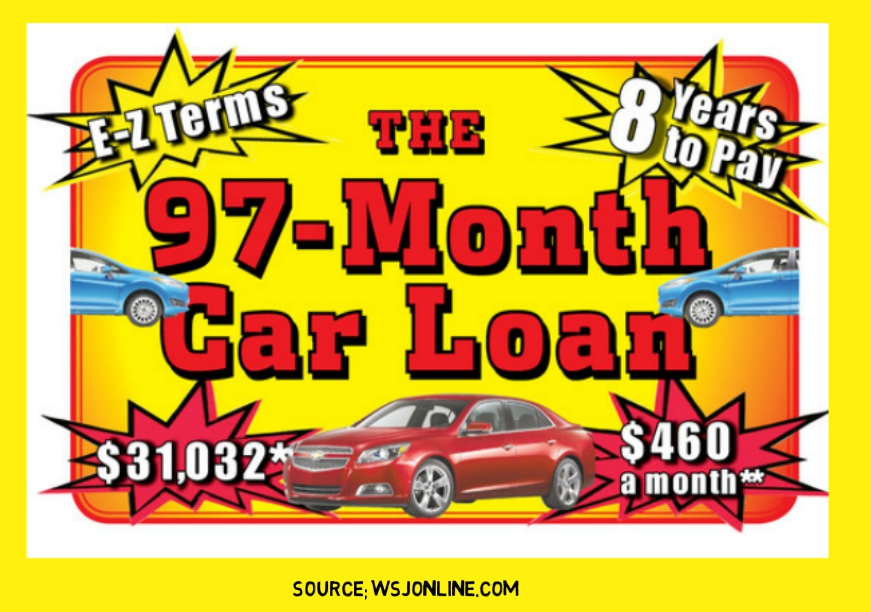

Jane’s thinking that’s she might be ready to buy her first home but her college beater has become increasingly unreliable and so she is thinking about replacing it with a brand new car.

Because she graduated with only the average student loan debt and pays her credit card off each month, she’s confident that she can buy her a starter home in Raleigh-Cary which is about $220,000.

So let’s do the math and see if Jane will qualify:

Let’s assume that Jane’s Student loan debt is $29,000 and let’s also assume that her monthly payments will be $250 per month when they come out of deferment sometime next year.