Hedging Against Inflation and Risk

“It’s not a matter of IF, but WHEN!” That old adage proved true last week as the fiscal problems in Europe came back to roost as predicted – even after being overshadowed recently by news from Japan and the Middle East.

Despite all the focus on government debt in Europe, it’s important to note that the problems are more than just financial; there is also a ton of political capital at risk. The stronger and more fiscally conservative Euro member countries like Germany and France do not want to pick up the tab for poor performing countries like Ireland, Greece, Portugal and many others standing in line behind them. And as news flows out of Europe – either good or bad – Mortgage Bonds and home loan rates here in the US will move in sympathy.

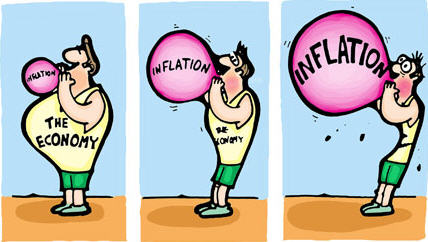

One news item that pressured Bonds lower last week was word that inflation in the United Kingdom (UK) jumped to the highest level in two years in February. Remember, inflation is the archenemy of Bonds, and inflation around the globe seeps into the US.

In fact, we’re already seeing it as Producer Prices (which look at wholesale inflation) are running at very hot levels… with prices up 3.3% in just the last three months. If pricing pressures don’t recede for producers of goods and services, companies will have one of two choices:

Either: Absorb the higher cost of goods – and, thereby, hurt earnings growth

Or: Pass those increased costs onto consumers – thereby, creating consumer inflation

Both of those scenarios would be bad for Stocks and Bonds. And since home loan rates are tied to Mortgage Backed Securities – which are a type of Bond – those scenarios would also be bad for home loan rates.

Speaking of Mortgage Backed Securities, last week the Treasury Department announced it is going to begin selling some of its massive Mortgage Backed Securities holdings. This is important to anyone looking to purchase or refinance a home. That’s because this announcement immediately pushed Bond prices significantly lower, as Traders tried to get their own positions sold. Think of it as a financial game of musical chairs… in which no one wants to be the last one standing with a mitt full of Mortgage Backed Securities. This isn’t the last we’ll hear about this – and since home loan rates are tied to Mortgage Backed Securities, this creates the potential for home loan rates to rise in the near future.

Fortunately, home loan rates are still at very attractive levels for now, despite the Bond market taking a hit for most of last week. So if you’ve been thinking about purchasing or refinancing a home, this is the time to see how you can benefit before rates possibly move higher. Because as bad as it was to lose some Bond pricing in the last few days, prices could move significantly worse depending on how they hold on to technical support.

For more information on what this means and how it may impact you or someone you know, call or email today. I’ll be happy to explain the situation and offer advice based on your unique situation.

0 Comments on “Hedging Against Inflation and Risk”