What is a My Community Mortgage?

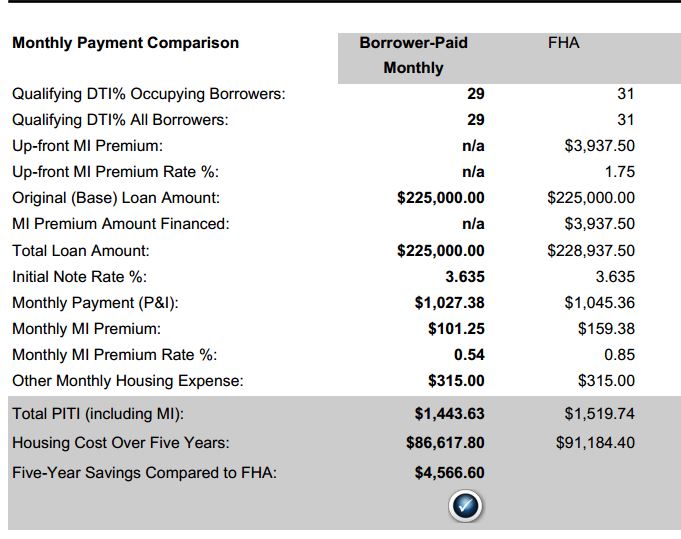

Below is an example of a person using a MCM to purchase a home with 3% down using today’s rates and comparing that to an FHA loan with similar rates. As you can see, the cost savings over a five year period are nearly $5,000!The primary benefit of using the My Community Mortgage over an FHA loan or even a traditional 3% conventional loan are the reduced monthly PMI rates which are half of the rates of 3% conventional loans. When compared to FHA loans, they are similarly cost effective.

If you’re a first time home buyer in Raleigh-Cary-Wake Forest shopping for an affordable mortgage, give me call to see if you are eligible for this loan program.

Related articles

Pages: 1 2

Pages: 1 2

0 Comments on “What is a My Community Mortgage?”